hey what's up guys bitcoin and ethereum

have been performing well in 2020 so far in this video i will explain what is a

better investment one full bitcoin or 30 eth

and yes it's 30 eth not 32 apparently not everyone can do first grade math

just want to say thank you for cobo volt for sending me this hardware

cryptocurrency wallet the cobo vault is one of the more

premium wallets available on the market today

which is reflected on this build quality the device has a nice and heavy feel to

it the cobo vault features a host of

premium securities this includes open sourcing its software

disabling wireless connection to the wallet and closing it

its military grade case that is both water and shock proof and

detachable and self-charging battery global wall starts at 99 dollars if you

use my link in the description box below you will get five percent off this is

not all they also send me a cobo tablet plus

where you can store your recovery seats with collaboration with cobo vault we

will be giving away three of this cobo tablet to you guys

all you have to do is subscribe to my channel like this video

and follow me on instagram and i will choose three winners on my instagram

let's take a look at the cryptocurrency market and see where we stand

but before we start please hit that like button it helps out a lot

and let's keep reporting those annoying cryptocurrency scammers

in the comment section below if you look at the bitcoin

the btc price is slightly correcting the current price as of the time of this

recording is at around 11 300 or so by the time you're watching

this the price could change it can be lower

or higher it looks like bitcoin might pull back a bit

from this point and we will see if there is going to be another consolidation

like we have seen in the beginning of the summer or if we

will see wild up and down swings if you look at

the year to date bitcoin still performing well relatively

to other asset classes at the beginning of january 2020 bitcoin

was trading at around seven thousand two hundred dollars

and now it's over eleven thousand three hundred dollars

that's over four thousand dollars gains or if you convert into percentage

that would be 57 increase year-to-date now let's take a look at ethereum all

cryptocurrencies right now including ech have been in the red for

the past few days the current price of eth is slightly

under 400 a coin ethereum recently reached 2 years

high last time it was at 400 back in august

2018 when eth was crashing down in this

devastating 2018 bear market in 2020 eth is performing

phenomenal in the beginning of the year in january

first one eth price was around 127 dollars a coin

you don't have to be a rocket scientist to figure it out that

its age performs much better than bitcoin

but bitcoin performs much better than any other asset classes

outside of cryptocurrencies ethereum gained over two hundred seventy dollars

a coin or two hundred fourteen percent

year-to-date sure we know that it age is better

performing asset in 2020 than bitcoin but the real question is if it will

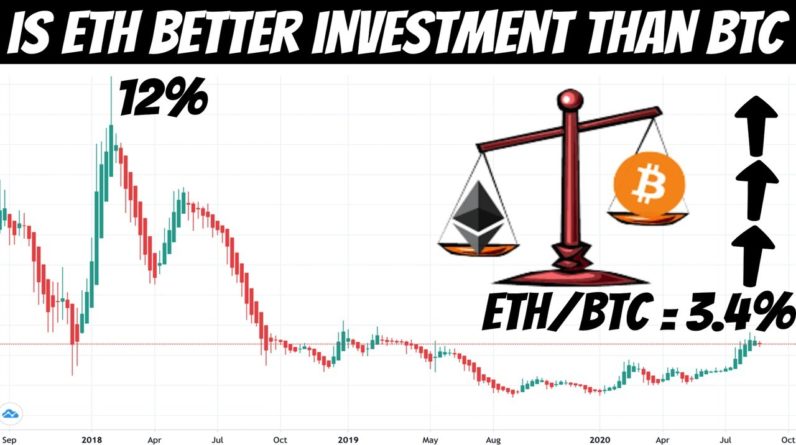

continue to perform better than bitcoin in foreseeable future if you look at this chart it represents

bitcoin price dominance comparing to other cryptocurrencies

we will notice that btc dominance is decreasing

while its age dominance is slightly increasing

it looks like its age is eating more and more shares of the entire cryptocurrency

pie back in 2017 bitcoin had over 85

dominance in the entire cryptocurrency market

then when the crazy bull market started things changed from zero to 100

real quick bitcoin's dominance dropped till 37 percent

while eth dominance increased still 31 this was the only time when eth came so

close to flip btc but that didn't happen and when we

entered into the bear market bitcoin started to regain its crown

while the ethereum dominance decreased now bitcoin's dominance is at 59

while eth increased till 12 also very interesting if you look at the

bigger picture since 2013 bitcoin starts to lose its

dominance power and it looks like this long-lasting

trend will continue to persist into the future but what is the biggest

cryptocurrency in the market besides bitcoin right now of course it's

ech so we can come to conclusion that over a

long run these two dominant power will converge

one more time which means ech is likely to outperform

bitcoin in price action also if you look at this chart it

represents its h3btc ratio if you do not know what it means we

simply take price of ech and divide that number by price of bitcoin

that is 385 dollars divided by 11 dollars and we get zero point zero three

four which means it's age price takes only

three point four percent of entire bitcoin

at the peak of 2017 bull market its age took as much

as 12 of one btc it looks like the trend of each to btc

ratio is likely to increase so currently you have a choice you can

buy one bitcoin for eleven thousand three hundred dollars

or you can buy approximately 30 eth for 380

each which one would i choose i will answer later in this video

but in meanwhile let's take a look what bitcoin jesus andre santanapos

he has to say about bitcoin versus ethereum debates

um well i'm i'm i'd have to speculate on their state of mind but i'll i'll try my

best i think it's important because it's a

framing assumption that drives the interest in bitcoin

uh bitcoin from the beginning uh was defined by its fixed

uh and immutable supply of no more not even up to 21 million coins and

a fixed issuance schedule that is set in stone or

rather set on the blockchain which is even stronger and

will not change it's um it's also one of the key characteristics because

bitcoin is first and foremost money and uh in fact it's money of a

particular kind it's hard money or sound money and

um that drives a lot of its appeal especially within some groups

who are interested in it with a very um specific austrian economics ideological

interests to just to clarify because i think this

point has been lost ethereum supply has validated every

block and it's validated according to the census rules and everybody who runs

an ethereum node um their node validates the supply there's no difference in that

fundamental mechanic from bitcoins fundamental consensus

rules with regards to validation of supply the

difference is that because of a variety of factors um

that are different in bitcoin than in ethereum

in bitcoin there is a specific api method you can

ask your node to give you the current sum uh and in ethereum it's not so easy

to do that that doesn't mean there is no sum that

doesn't mean that the sum isn't validated part of the consensus rules it

just seems that it just means that that's not an easily

accessible answer and depending on how you write

the script that comes up with the answer and the methodology you use you might

come up with some slightly differing answers the

first one is that bitcoin doesn't use a double entry

bookkeeping account balance system instead it uses a

system that's more like tracking um fixed amount coins through

the system and these are called unspent transaction outputs and at any

moment in time it keeps a database of the current

unspent transaction outputs and so it's it's very easy to

just sum them up so the the current state of the

unspent transaction output database is easy to access ethereum doesn't use

um fixed amount coins um indivisible chunks of currency as bitcoin does

instead it uses a system of accounts these

accounts have credits and debits these credits and debits are reconciled

as part of consensus and have to add up but in order to figure out what the

exact balance of any account is or to sum the balance

of all the accounts you have to go back to the genesis block

and then you just have to run through the pluses and minuses until you arrive

at an answer and so that takes more work

it takes even more work because of some historic anomalies in the

um ethereum blockchain there's a period where

um validating the state takes a a significant amount of computation due to

a bug that allowed a denial of service attack that's

not neither here nor there you can't validate it it just takes more time

and so once you add up all of these numbers you can get an

answer however that answer changes every 15 seconds because

bitcoin has 40 blocks in the same time sorry ethereum has 40 blocks in the same

time the bitcoin has one i think ethereum has been migrating

towards proof of stake for a very long time

and that's one of the reasons why criticizing this proof-of-work system

doesn't really make sense because you know it's just an interim system

um i don't know whether proof-of-stake really makes ethereum better

money i still think that some of the design tradeoffs required

to run a smart contracts platform that make

ether a utility token for the explicit purpose of being used as gas

to meter the execution of smart contracts all of these things involve

some pretty fundamental design trade-offs

which in my mind don't make ethereum primarily sound money it can have

the function of money also just like gasoline

can yeah sure you primarily use it to put it in your car but you could

build an underground thousand gallon tank and use that to barter in the

apocalypse um but you know that's the apocalypse

or it might be and some people are i'm sure are hoarding gas or beans

um that doesn't make those things money um

even though they have value so and again you know i have this i have a

similar and opposite impression of bitcoin which is that bitcoin isn't a

good platform for smart contracts and that's

a good thing because it was never meant to be and shouldn't

try to be because everything that it does to be

sound money um kind of undermines its ability to be a smart

contracts platform and vice versa and these compromises serve a purpose

um these trade-offs serve a purpose i've talked about this extensively in a video

i call the lion and the shark where i describe um these types of

divergent evolution where you have a cryptocurrency or

blockchain that is an apex predator within its own domain of

applications just like the line as a apex predator in

the savannah and the shark is an apex predator of the

ocean and kind of comparing them or trying to apply the framing

assumptions of one on the other doesn't make sense um so to give you

to take that analogy a bit further criticizing ethereum

for um its total supply is a bit like the um denizens of the savannah saying

well shark you you don't have sharp claws and

four paws so you can't run and catch gazelles and

we all know that catching gazelles is the most important thing in the

savannah um you know sure it's it's a valid argument

if that's what you're trying to do but that's not what the shark is trying

to do and it doesn't make sense to criticize the

shark for not having claws any more than it

it makes sense to criticize the lion from looking

really ridiculous when it's trying to swim in the ocean

um these are not systems that compete directly

against each other and not because they're weak but

because their strength lies in specialization

that adapts them for one purpose while simultaneously

maladapting them for other purposes and that's a good thing we need

specialization um so you know that's why i think it's

it's all a silly argument and you you can go on

forever down that path but the bottom line is

they're not really competing we know that bitcoin has fixed supply

there won't be more than 21 million bitcoins

ever every four years bitcoin's inflationary supply drops in half

just recently in may we had bitcoin having where btc

mining reward dropped from 12.5 btc till 6.25 btc per block

so it has very appealing mathematical algorithm

with a fixed supply that essentially makes bitcoin is out money

no one can change the algorithm to inflate bts in circulation

no one can print more bitcoin just like fat does with our currency

and no one can stop bitcoin from running it's not work

this is why lots of libertarians choosing bitcoin

over essential control of federal government that proved over and over

again throughout the history that our currency is not sound money

with ethereum is different i saw many comments in the section below

whenever i make video about hch many viewers say something like that

i wish eth would have a hardcap supply and i disagree with that statement in

fact i agreed with andreas antonopoulos who says that

comparing bitcoin to ethereum is like comparing apples to oranges

it doesn't make too much sense doing so eth

is not trying to beast out money just like bitcoin or even gold

its age main objection is to be the platform where developers can build

decentralized applications and execute smart contracts

to do so in high volume its age needs to be scalable

for any platform to be scalable it has to have slight inflation built into the

network it's very similar to modern monetary

theory they print money and they are able to

scale the economy as long as they control the currency

supply and do not print too much the economy will likely to scale as well

i would argue that we won't be where we are today if we

were at the gold standard if we would have gold as a reserve

currency today we would be in deflationary environment

not many people would want to spend gold if there is no spending there would be

no consumption if there is no consumption

there would be no economic growth more than 70

of us gdp is driven by consumption similar argument we can make with

ethereum if we want to have scalable network

we need to have slight inflation as simple as that

and i do not want to hear that bullshit anymore that

it should have hard cap supply going back to the question what would i

choose one bitcoin or 30 eth if someone would put a gun to my hat i

would choose 30 ech because i believe its age will

outperform bitcoin in any bull market if you are an old grandpa that wants to

retire comfortably i would recommend choosing bitcoin since

bitcoin is more safer investment than ethereum

but if i can choose freely why not to choose both

apples are good oranges are good but apples and oranges

are even better bitcoin and ethereum have different functions

so it's better to own both if you have 11

300 that you are desperately want to invest in cryptocurrency and you do not

know what to choose one bitcoin and 38ch i would spend six thousand eight hundred

dollars buying bitcoin and remaining four thousand five hundred

dollars buying eth that would be 60 40 split let me know

what do you guys think what would perform better one bitcoin or

30 ech leave your thoughts in the comment

section below smash that like button and subscribe