At a very basic level, Bitcoin is just a digital

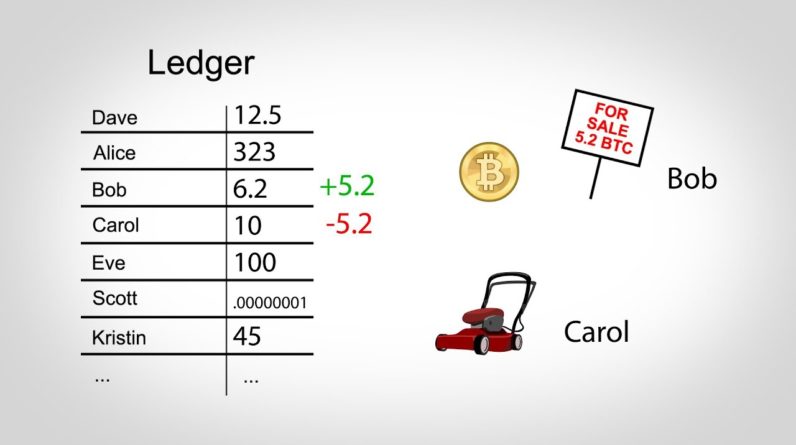

file or ledger that contains names and balances, and people exchange money by changing this

file. When Bob sells Carol a lawn mower for 5.2 Bitcoins, Bob's balance goes up by 5.2,

and Carol's down by 5.2. There's no gold or government issued money backing these numbers. Bob is only willing to trade his real-life lawn mower for a higher number in this digital file because he has faith that other people will also trust the system. So who maintains this ledger and makes sure

no one cheats? One goal of Bitcoin is to avoid any centralized control, so every participant

maintains their own copy of the ledger. One surprising consequence of this is that everyone

can see everyone else's balances, although the real system only uses account numbers

and not names, so there's some level of anonymity. If everyone maintains their own ledger, how

are all the ledgers kept in sync as money is transferred? At a basic level, when you

want to send money, you simply tell everyone else by broadcasting a message with your account

number, the receiver's, and the amount.

Everyone across the entire world then updates their

ledger. As a quick aside, I'm describing how Bitcoin

works for power users–people who help maintain the system. You can also just use the system

to send a receive money, though, without maintaining a ledger. If sending money is as simple as creating

a message with some account numbers, what's to stop a thief, Alice, from spending Bob's

money by using his account number? Like a pen and paper check, Bitcoin requires a kind

of signature to prove that the sender is the real owner of an account, but it's based on

math rather than handwriting.

When a new account number is created, it comes

along with a private key mathematically linked to that account number. If you've heard of

a Bitcoin wallet, these keys are what it holds, and are what allow you to create signatures. To create a signature, a private key and the

text from a transaction are fed into a special cryptographic function. Another function allows

other people to check the signature, making sure it was created by the account owner,

and that it applies to that specific transaction. Unlike the handwritten version, these signatures

can't be copied and reused in the future, as they're unique to each transaction. While the mathematical signatures prove who

sent a transaction, they can't prove when it was sent, and this turns out to be problematic.

In our traditional banking system, if Alice

wrote two checks, but only had enough money to cover one of them, the bank would pay the

first person attempting to cash his check, but refuse the 2nd, because Alice's account

would be empty. So the order of these checks is critical,

because it determines who should get paid. Unfortunately, order is much harder to determine

in Bitcoin, where instead of single bank, there are individuals all over the world.

Network delays might cause transactions to arrive in different orders at different places,

and fraudsters could lie about timestamps. Two recipients might both think their transaction

is first and ship a product, effectively allowing Alice to spend her money twice! Bitcoin prevents

this by providing a way for the entire world to decide on transaction order.

As new transactions are created, they go into

a pool of pending transactions. And from here, they'll be sorted into a giant chain that

locks in their order. To select which transaction is next, a kind

of mathematical lottery is held. Participants select a pending transaction of their choice,

and begin trying to solve a special problem that will link it to the end of the chain.

The first person to find a solution wins, and gets to have their transaction selected

as the next in the chain. So what's this linking problem? It's based

on a special function called a cryptographic hash. As scary as this sounds, it just mixes

up its inputs and spits out a number, but it's special because it's irreversible. There's

no easy way to start with an output and then find an input that generates it other than

making lots of guesses. And this is literally what people are doing in Bitcoin–feeding

this function random numbers until the output meets certain criteria. Besides a random guess, you also input a transaction

from the pending pool and chain, which is where the linking part comes in.

So the lottery provides a way for the entire

world to decide which transaction is next, but the math behind it also helps ensure that

everyone agrees about past transactions, too. Suppose you're joining the network for the

first time, and request a copy of the transaction chain to get caught up, but receive several

different versions. Which one should you trust? Ideally, you would trust the one that the

majority of people are using, but determining this on the internet is difficult. What would

stop a single person from voting millions of times? Bitcoin prevents this by requiring

people to solve math problems to vote. This causes each vote to have a cost in computing

power, making it unlikely that a single person or group could ever afford to outvote or out-compute

the majority of users. The transaction ordering process described

before actually provides the voting system. Part of the input to the linking problem is

a transaction from the end of a chain, so each guess is effectively a vote for that

chain.

But how are all the votes tallied? Because the cryptographic hash function has

well defined statistical properties, you can look at any given answer and estimate how

many guesses it took to find it, just like estimating how many coin flips it would take

to get 100 heads in a row. So the links in a chain not only put transactions in order,

but also act as an effective vote tally, making it easy to see which chain most people are

using. Finally, how does the money get created? Every

time someone wins the lottery to pick the next transaction in the chain, new Bitcoins

are created out of thin air and awarded to their account. Solving these problem is commonly called "mining,"

as this is how money enters the system, but the main purpose of the math is to make sure

everyone's ledgers agree. The math simply provides a convenient way to randomly distribute

money into the world. In fact, sometime around 2140, no more money will be created, and participants

will only be paid from fees added on to transactions. I hope this gives you a quick sense for how

Bitcoin works.

If you'd like a more detailed summary, check out my 22 minute video: How

Bitcoin Works Under the Hood..