[David]: I should start by thanking Cliff

Lynch for inviting me back even though I'm retired, and for letting me debug this talk

at Berkeley's Information Access Seminar. I plan to talk for 20 minutes and leave plenty

of time for questions. A lot of information will be coming at you

fast. Afterwards, I encourage you to consult the

whole text of my talk and much additional material on my blog. Follow the links to the sources to get the

details that you probably missed. We’re in a period when blockchain or distributed

ledger technology is the solution to everything, so it's inevitable that it will be proposed

as a solution to the problems of academic communication and digital preservation. In the second of a three-part series, Ian

Mulvaney has a comprehensive review of the suggested applications of blockchain for academic

communication in three broad classes.

Those are priority claims, access to resources,

and rights. Mulvaney discusses each of them in some detail

and doesn't find a strong case for any of them. In a third part, he looks at some of the implementation

efforts currently underway and divides their motivations into two groups. I quote, “The first comes from commercial

interests where management of rights, IP and ownership is complex, hard to do, and has

led to unusable systems that are driving researchers to sites like Sci-Hub, scaring the bejesus

out of publishers in the process. The other trend is for a desire to move to

a decentralized web and a decentralized system of validation and reward, in a way trying

to move even further away from the control of publishers. It is absolutely fascinating to me that two

diametrically opposite philosophical sides are converging on the same technology as the

answer to their problems.

Could this technology perhaps be just holding

up an unproven and untrustworthy mirror to our desires, rather than providing any real

viable solutions?" This talk answers Mulvaney's question in the

affirmative. I've been writing skeptically about cryptocurrencies

and blockchain technology for more than five years. What are my qualifications for such a long

history of pontification? More than fifteen years ago, nearly five years

before Satoshi Nakamoto published the Bitcoin protocol, a cryptocurrency based on a decentralized

consensus mechanism using proof-of-work, my co-authors and I won a "best paper" award

at the prestigious SOSP workshop for a decentralized consensus mechanism using proof-of-work.

It's the protocol underlying the LOCKSS system. The originality of our work didn't lie in

decentralization, distributed consensus, or proof-of-work. All of these were part of the nearly three

decades of research and implementation leading up to the Bitcoin protocol, as described by

Arvind Narayanan and Jeremy Clark in a paper called Bitcoin's Academic Pedigree. Our work was original only in its application

of these techniques to statistical fault tolerance; Nakamoto's only in its application of them

to preventing double-spending in cryptocurrencies. We're going to walk through the design of

a system to perform some function, say monetary transactions, storing files, recording reviewers'

contributions to academic communication, verifying archival content, whatever. Being of a naturally suspicious turn of mind,

you don't want to trust any single central entity, but instead want a decentralized system. You place your trust in the consensus of a

large number of entities, which will in effect vote on the state transitions of your system

– the transactions, reviews, archival content, whatever.

You hope that the good entities will out-vote

the bad entities. In the jargon, the system is trustless, which

is a misnomer. Techniques using multiple voters to maintain

the state of a system in the presence of unreliable and malign voters were first published in

The Byzantine Generals Problem by Lamport and coauthors in 1982. Alas, Byzantine Fault Tolerance (BFT) requires

a central authority to authorize entities to take part. In the blockchain jargon, it is permissioned. You would rather let anyone interested take

part, a permissionless system with no central control. The security of your permissionless system

depends upon the assumption of uncoordinated choice, the idea that each voter acts independently

upon its own view of the system's state. If anyone can take part, your system is vulnerable

to Sybil attacks, in which an attacker creates many apparently independent voters who are

actually under his sole control.

If creating and maintaining a voter is free,

anyone can win any vote they choose simply by creating enough Sybil voters. So creating and maintaining a voter has to

be expensive. Permissionless systems can defend against

Sybil attacks by requiring a vote to be accompanied by a proof of the expenditure of some resource. This is where proof-of-work comes in; a concept

originated by Cynthia Dwork and Moni Naor in 1992. To vote in a proof-of-work blockchain such

as Bitcoin's or Ethereum's requires computing very many otherwise useless hashes. The idea is that the good voters will spend

more, compute more useless hashes, than the bad voters. Brunnermeir and Abadi's Blockchain Trilemma

shows that a blockchain has to choose at most two of the following three attributes, that's

correctness, decentralization, and cost-efficiency.

Obviously, your system needs the first two,

so the third has to go. Running a voter – mining, in the jargon – in

your system has to be expensive if the system is to be secure. No one will do it unless they are rewarded. They can't be rewarded in fiat currency, because

that would need some central mechanism for paying them. So the reward has to come in the form of coins

generated by the system itself, a cryptocurrency. To scale, permissionless systems need to be

based on a cryptocurrency. The system's state transitions will need to

include cryptocurrency transactions in addition to records of files, reviews, archival content,

whatever. Your system needs names for the parties to

these transactions. There is no central authority handing out

names, so the parties need to name themselves. As proposed by David Chaum in 1981, they can

do so by generating a public-private key pair, and using the public key as the name for the

source or sink of each transaction. In practice, this is implemented in wallet

software, which stores one or more key pairs for use in transactions. The public half of the pair is a pseudonym.

Unmasking the person behind the pseudonym

turns out to be fairly easy in practice. The security of the system depends upon the

user and the software keeping the private key secret. This can be difficult, as Nicholas Weaver's

computer security group at Berkeley discovered when their wallet was compromised and their

Bitcoins were stolen. The capital and operational costs of running

a miner include buying hardware, power, network bandwidth, staff time, etc. Bitcoin's volatile price, high transaction

fees, low transaction throughput, and large proportion of failed transactions mean that

almost no legal merchants accept payment in Bitcoin or any other cryptocurrency. Thus one essential part of your system is

one or more exchanges, at which the miners can sell their cryptocurrency rewards for

the fiat currency they need to pay their bills. Who is on the other side of those trades? The answer has to be speculators, betting

that the price of the cryptocurrency will increase. Thus a second essential part of your system

is a general belief in the inevitable rise in price of the coins by which the miners

are rewarded. If miners believe that the price will go down,

they will sell their rewards immediately, a self-fulfilling prophesy.

Permissionless blockchains require an inflow

of speculative funds at an average rate greater than the current rate of mining rewards if

the price is not to collapse. To maintain Bitcoin's price at $4,000 – it's

currently about 3,500 – requires an inflow of $300,000 an hour. In order to spend enough to be secure, say

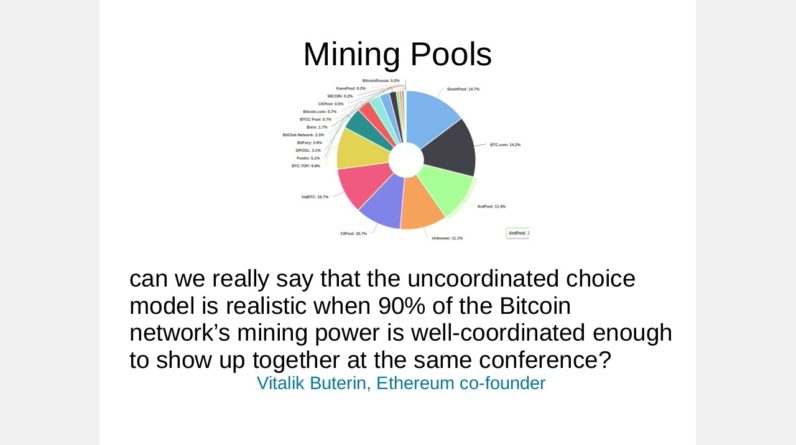

$300,000 an hour, you need a lot of miners. It turns out that a third essential part of

your system is a small number of mining pools. Bitcoin has the equivalent of around 3 million

Antminer S9 chips, and a block time of ten minutes. Each S9, costing maybe $1,000, can expect

a reward about once every 60 years. It will be obsolete in about a year, so only

one in 60 will ever earn anything. To smooth out their income, miners join pools,

contributing their mining power and receiving the corresponding fraction of the rewards

earned by the pool. These pools have strong economies of scale,

so successful cryptocurrencies end up with a majority of their mining power in three

to four pools.

Each of these big pools can expect a reward

about every hour or so. These blockchains aren’t decentralized,

but centralized around a few large pools. At multiple times in 2014, one mining pool

controlled more than 51% of the Bitcoin mining power. At almost all times since, three to four pools

have controlled the majority of the Bitcoin mining power. Currently two of them are controlled by Bitmain,

the dominant supplier of mining ASICs. With the advent of mining-as-a-service, 51%

attacks have become endemic among the smaller alt-coins. The security of a blockchain depends upon

the assumption that these few pools are not conspiring together outside the blockchain,

an assumption that is impossible to verify in the real world, and, by Murphy's Law, is

therefore false. Similar off-chain collusion among cryptocurrency

traders allows for extremely profitable pump-and-dump schemes. In practice, the security of a blockchain

depends not merely on the security of the protocol itself, but on the security of the

core software and the wallets and exchanges used to store and trade its cryptocurrency.

This ancillary software has bugs, such as

the recently revealed major vulnerability in Bitcoin Core, the Parity Wallet fiasco,

and the routine heists using vulnerabilities in exchange software. Recent game-theoretic analysis suggests that

there are strong economic limits to the security of cryptocurrency-based blockchains. For safety, the total value of transactions

in a block needs to be less than the value of the block reward. Your system needs an append-only data structure

to which records of the transactions, files, reviews, archival content, whatever are appended. It would be bad if the miners could vote to

re-write history, undoing these records. In the jargon, the system needs to be immutable,

which is another misnomer.

The necessary data structure for this purpose

was published by Stuart Haber and W. Scott Stornetta in 1991. A company using their technique has been providing

a centralized service of securely time-stamping documents, effectively a blockchain, for nearly

a quarter of a century. It is a form of Merkle, or hash tree, published

by Ralph Merkle in 1980. For blockchains, it's a linear chain to which

fixed-size blocks are added at regular intervals. Each block contains the hash of its predecessor,

so it's a chain of blocks. The blockchain is mutable, it's just rather

hard to mutate it without being detected, because of the Merkle tree’s hashes, and

easy to recover, because there are Lots Of Copies Keeping Stuff Safe. But this is a double-edged sword.

Immutability makes systems incompatible with

the GDPR, and immutable systems to which anyone can post information will be suppressed by

governments. A user of your system wanting to perform a

transaction, store a file, record a review, whatever, needs to persuade miners to include

their transaction in a block. Miners are coin-operated; you need to pay

them to do so. How much do you need to pay them? That question reveals another economic problem,

fixed supply and variable demand, which equals variable price.

Each block is, in effect, a blind auction

among the pending transactions. So let’s talk about CryptoKitties, a game

that bought the Ethereum blockchain to its knees, despite the bold claims that it could

handle unlimited decentralized applications. How many users did it take to cripple the

network? It was far fewer than non-blockchain apps

can handle with ease. CryptoKitties peaked at about 14,000 users. NeoPets, a similar centralized game, peaked

at about 2,500 times as many. CryptoKitties' average price per transaction

spiked 465% between November 28 and December 12 as the game got popular, a major reason

why it stopped being popular. The same phenomenon happened during Bitcoin's

price spike around the same time. Cryptocurrency transactions are affordable

only if no one wants to transact. When everyone does, they immediately become

unaffordable. Nakamoto's Bitcoin blockchain was designed

only to support recording transactions. It can be abused for other purposes, such

as storing illegal content. But it is likely that you need additional

functionality, which is where Ethereum's smart contracts come in. These are fully functional programs, written

in a JavaScript-like language that are embedded in Ethereum's blockchain.

They are mainly used to implement Ponzi schemes,

but they can also be used to implement Initial Coin Offerings, games such as Cryptokitties,

and gambling parlors. Further, in On-Chain Vote Buying and the Rise

of Dark DAOs, Philip Daian and co-authors show that smart contracts also provide for

untraceable on-chain collusion in which the parties are mutually pseudonymous. Smart contracts are programs, and programs

have bugs. Some of the bugs are exploitable vulnerabilities. Research has shown that the rate at which

vulnerabilities in programs are discovered increases with the age of the program. The problems caused by making vulnerable software

immutable were revealed by the first major smart contract.

The Decentralized Autonomous Organization,

the DAO, was released on the 30th of April 2016, but on the 27th of May 2016 Dino Mark,

Vlad Zamfir, and Emin Gün Sirer posted A Call for a Temporary Moratorium on The DAO,

pointing out some of its vulnerabilities; it was ignored. Three weeks later, when The DAO contained

about 10% of all the Ether in circulation, a combination of these vulnerabilities was

used to steal its contents. The loot was restored by a hard fork, the

blockchain's version of mutability.

Since then it has become the norm for smart

contract authors to make them "upgradeable," so that bugs can be fixed. "Upgradeable" is another way of saying immutable

in name only. So, this is the list of people your permissionless

system has to trust if it's going to work as advertised over the long term. So where have we ended up? You started out to build a trustless, decentralized

system but you have ended up with a trustless system that trusts a lot of people you have

every reason not to trust; a decentralized system that is centralized around a few large

mining pools that you have no way of knowing aren’t conspiring together; an immutable

system that either has bugs you cannot fix, or is not immutable; a system whose security

depends on it being expensive to run, and which is thus dependent upon a continuing

inflow of funds from speculators; and a system whose coins are convertible into large amounts

of fiat currency via irreversible pseudonymous transactions, which is thus an irresistible

target for crime. If the price keeps going up, the temptation

for your trust to be violated is considerable. If the price starts going down, the temptation

to cheat to recover losses is even greater.

So maybe it's time for a re-think. Suppose you give up on the idea that anyone

can take part and accept that you have to trust a central authority to decide who can

and who can’t vote. You will have a permissioned system. The first thing that happens is that it is

no longer possible to mount a Sybil attack, so there is no reason running a node need

be expensive. You can use BFT to establish consensus, as

IBM’s Hyperledger, the canonical permissioned blockchain system, does. You need many fewer nodes in the network,

and running a node just got way cheaper. Overall, the aggregated cost of the system

got orders of magnitude cheaper. Now there is a central authority. It can collect fiat currency for network services

and use it to pay the nodes. No need for cryptocurrency, exchanges, pools,

speculators, or wallets, so much less temptation for bad behavior. This is now the list of entities you trust. Trusting a central authority to determine

the voter roll has eliminated the need to trust a whole lot of other entities.

The permissioned system is more trustless,

and since there is no need for pools, the network is more decentralized despite having

fewer nodes. How many nodes does your permissioned blockchain

need? The rule for BFT is that 3f + 1 nodes can

survive f simultaneous failures. That's an awful lot fewer than you need for

a permissionless proof-of-work system. What you get from BFT is a system that, unless

it encounters more than f simultaneous failures, remains available and operating normally. The problem with BFT is that, if ever it encounters

more than f simultaneous failures, the state of the system is irrecoverable.

If you want a system that can be relied upon

for the long term, you need a way to recover from disaster. Successful permissionless blockchains have

Lots Of Copies Keeping Stuff Safe, so recovering from a disaster that doesn't affect all of

them is manageable. So in addition to implementing BFT, you need

to back up the state of the system each block time, ideally to write-once media so that

the attacker can't change it. But if you're going to have an immutable backup

of the system's state, and you don't need continuous uptime, you can rely on the backup

to recover from failures. In that case, you can get away with, say,

two replicas of the blockchain in conventional databases, saving even more money. I've shown that, whatever consensus mechanism

they use, permissionless blockchains are not sustainable for very fundamental economic

reasons.

These include the need for speculative inflows

and mining pools, security linear in cost, economies of scale, and fixed supply versus

variable demand. Proof-of-work blockchains are also environmentally

unsustainable. The top five cryptocurrencies are estimated

to use as much energy as The Netherlands. This isn't to take away from Nakamoto's ingenuity. Proof-of-work is the only consensus system

shown to work well for permissionless blockchains at scale. The consensus mechanism works, but energy

consumption and emergent behaviors at higher levels of the system make it unsustainable. So now there's time for questions..