The following content is

provided under a Creative Commons license. Your support will help

MIT OpenCourseWare continue to offer high quality

educational resources for free. To make a donation or to

view additional materials from hundreds of MIT courses,

visit MIT OpenCourseWare at ocw.mit.edu. ALIN TOMESCU: My name is Alin. I work in Stata, in

the Stata Center. I'm a PhD student

there in my fifth year. And today we're going

to be talking about one of our research

project called Catena. And Catena is a really

nice way of using bitcoin to build append-only logs. Bitcoin itself is

an append-only log. And a lot of people have been

using it to put data in it. And I'll describe a

really efficient way of doing that and

its applications. And if there is time, we'll talk

about a tax and maybe colored coins and some other stuff. We'll talk about the

what, the how and the why. And that's the overview

of the presentation. So let's talk about this

problem called the equivocation problem.

So what is this? In general, non-equivocation

means saying the same thing to everybody. So for example, if you

have a malicious service and you have Alice

and Bob, the service should say the same

thing to Alice and Bob. So it would make a

bunch of statements. Let's say s1, s2, s3 over

time and Alice and Bob would see all of

these statements. So this is very similar to

what bitcoin provides, right? In bitcoin you see block

one, block two, block three. And everybody agrees on these

blocks in sequence, right? Does that make sense? So this is non-equivocation

and in some sense this is what bitcoin

already offers.

And in general with

non-equivocation, what you might get is

some of these statements might actually be

false or incorrect. Non-equivocation

doesn't guarantee you that this statement is

a correct statement. But it just guarantees

you that everybody sees the same statements. And then they can detect

incorrect statements. In bitcoin you get

a little bit more. You actually know that

if this is a block, it's a valid block, assuming

there are enough blocks on top of it, right? So equivocation means saying

the same thing to everybody. So for example, this malicious

service at time four, he might show Bob a different

statement than Alice. So Bob sees s4 and

Alice sees s4 prime.

This is what happens

in bitcoin sometimes. And that's how you can

double spend in bitcoin by putting the transaction here

sending money to the merchant, and then putting

another transaction here sending money back to you. Right, are you guys

familiar with this? Yeah, OK. All right, so why

does this matter? Let me give you a silly example. Suppose we have Jimmy and we

have Jimmy's mom and Jimmy's dad, right? And Jimmy wants to

go outside and play. But he knows that mom and dad

usually don't let him play. So what he does is he

tells dad, hey dad, mom said I can go outside. Right, and then he

tells mom, hey mom. Dad said I can go outside. And let's say mom and dad

are in different rooms and they're watching soap

operas and they're not talking to one another. So they can actually

confirm that.

You know, mom can confirm

that dad really said that. And dad can really confirm

that mom said that. But they both trust Jimmy. So you see how equivocation

can be really problematic because now mom and

dad will say sure, go outside as long as the

other person said that, right? But let me give you a

more practical example. So let's look at something

called a public-key directory. A public-key directory allows

you to map user's public keys– a user name to a public key. Right, so here I have

the public key for Alice and here I have the

public key for Bob.

And they look up each other's

keys in this directory. And then they can set

up a secure channel. How many of you guys use

Whatsapp, for example? So the Whatsapp server has

a public-key directory. And when I want to

send you a message, I look up your phone

number in that directory and I get your

public key, right? If that directory equivocates,

the following thing can happen. What the directory can do is

it can create a new directory at time two where he puts

a fake public key for Bob and he shows this

to Alice, right? And at time two also, he creates

another directory for Bob where he puts a fake public

key for Alice, right? So now the problem

here is that when Alice checks in this directory,

she looks at her own public key to make sure she's

not impersonated.

And Alice looks in this

version and sees, OK. That is my public key. I'm good. She looks in this version, OK. This is my public key. I'm good. So now I'm ready to

use this directory. And I'll look up Bob and

I'll get his public key. But Alice will actually

get the wrong public key. Does everybody see that? And similarly Bob

will do the same. So Bob will look in his fork

of the directory, right? And he looks up his key

here and his key here. And he thinks he's OK. He's not impersonated. But in fact, Alice has

impersonated there. OK? And now as a result, they

will obtain fake keys for each other. And this man in the

middle, attacker who knows the

corresponding secret keys for these public

keys can basically read all of their

communications. Any questions about this? This is just one example

of how equivocation can be really disastrous. So in a public-key directory,

if you can equivocate, you can show fake

public keys for people and impersonate them. So in other words,

it's really important that Alice and Bob both

see the same directory.

Because if Bob saw

this directory, the same one Alice saw, then Bob

would notice that this is not the public key he had. He would notice his

first public key and then that there's a second one there. And then he would know

he's impersonated. And he could let's say,

talk to the New York Times, and say, look. This directory is

impersonating me. So in conclusion, equivocation

can be pretty bad. So this idea that you

say different things to different people can

be pretty disastrous.

And what Catena does

is it prevents that. So in general, if you have

this malicious service that is backed by Catena, if it

wants to say different things to different people.

it cannot do that. It has to show the same

thing to everybody. And the way we achieve that is

by building on top of bitcoin. And that's what we're going

to be talking about today. So any questions about

sort of the general setting of the problem and

our goals here? So let's move on then. So why does this matter? So this matters for a

bunch of other reasons, not just public-key directories

and secure messaging. It matters because when you want

to do secure software update, equivocation is a problem. And I'll talk about that later. So for example, at

some point bitcoin was concerned about

malicious bitcoin binaries being published on

the web and people like you and me

downloading those binaries and getting our coins stolen.

Right, and it turns out that

that's an equivocation problem. Somebody is equivocating, right? It's equivocating about

the bitcoin binary. It's showing us a

fake version and maybe other people the real version. Secure messaging,

like I said before, has applications here and. Not just secure messaging

but also the web. Like when you go

on Facebook.com, you're looking up

Facebook's public key. And if somebody lies to

you about that public key, you could be going to

a malicious service and you could be giving

them your Facebook password.

Does that make sense? And also it has

applications in the sense that if you have a way of

building a append-only log, you really have a way of

building a blockchain right for whatever purpose you want. And we'll talk

about that as well. So the 10,000 feet

view of the system is we built this bitcoin

based append-only log. And the way to think about

is that bitcoin is already an append-only log. It's just that it's kind

of inefficient to look in that log. If you want to pick certain

things from the Bitcoin blockchain, like you put your

certain bits and pieces of data there, you have to

kind of download the whole thing to make sure

you're not missing anything.

And I'll tell you why soon. So instead of

putting stuff naively in the Bitcoin

blockchain, we put it in a more principled way. And in a sense we get

a log and another log. We get our log and

the bitcoin log. And this generalizes to

other cryptocurrencies. Like you could do

this in light coin, for example, or

even in ethereum. Though I don't

think you guys yet talked about how the

ethereum blockchain works. And the cool thing about this

Catena log that we're building is that the Catena log is as

hard to fork as the bitcoin blockchain. If you want to fork our log,

you have to fork bitcoin.

However, unlike the

Bitcoin blockchain, Catena is super

efficient to verify. So in particular, remember,

I described the log in terms of the

statements in it. So if you have 10

statements, each statement will be 600 bytes to audit. So you don't have to

download the whole Bitcoin blockchain to make sure you're

not missing a statement. And you also have to download

80 bytes per bitcoin block. And we have a Java

implementation of this. And if you guys are curious,

you can go to my GitHub page, and take a look at the code. All right, so before we

start, I know you guys already know a lot about how

the Bitcoin blockchain, but it's important that I

reintroduce some terminology just so we're on the same page. So this is the

bitcoin blockchain. We have a bunch of

blocks connected by hash chain pointers. And we have Merkle

trees of transactions. And you know, these arrows

indicate hash pointers. It means that block n stores a

hash of block n minus 1 in it, right? So in that sense.

Block n has a hash pointer

to block n minus 1. All right, and like I said,

each tree has a Merkle tree. Each block has a Merkle tree. And everybody

agrees on this chain of blocks via proof of work

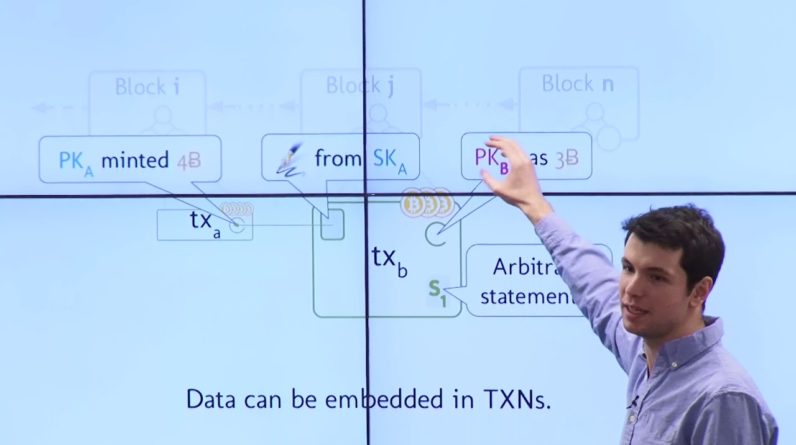

consensus, which all of you already know. And importantly, in the Merkle

trees, we have transactions. And transactions

can do two things. Right, a transaction can

mint coins, create new coins. So here I have transaction a. It created four coins by

storing them in an output. Are you familiar with outputs? So you guys already discussed

transaction outputs and inputs. So that's what we're going

over here again real quick.

So an output specifies

the number of coins and the public key of

the owner of those coins, as you already know. And the second purpose

of transactions is that they can transfer

coins, right, and pay fees in the process. So here if you have

a transaction b, this transaction b

might say, hey, here's a signature from the

owner of these coins here. Here's a signature

and transaction b. And here's the new

owner with public key b of three of those four coins.

And one of those coins

I'll just give it to the miners as

a transaction fee. Does this make sense? How many of you are with me? All right, any questions

about how transaction inputs and outputs work? So if you remember

in the input here, you have a hash pointer

to the output here. All right. So and the high

level idea here is that the output

is just the number of coins in a public key. And the input is a hash

pointer to an output plus a digital signature from

that output's public key, OK? And yeah, so what

happens here is that transaction b is spending

transaction a's first output. Right, that's the terminology

that we're going to use. And I think you

guys have already used terminology like this. And in addition, what we're

going to talk about today is the fact that in these

bitcoin transactions you can actually embed data.

And I think you touched briefly

on this concept of op return transaction outputs. Right, so this is an output that

sends coins to a public key. But here I can have an output

that sends coins to nobody. It just specifies some data. And in fact, I'll use that

data to specify the statements that I was talking

about earlier. So that the high

level point here is that you can embed data

in bitcoin transactions using these operations. And there's a bunch of other

ways to do it, actually. Like initially

what people did is they put the data

as the public key. They just set the

public key to the data.

And in that sense, they

kind of wasted bitcoins. Right, they said hey,

send these three bitcoins to this public key, which

is just some random data. But nobody would know the

corresponding secret key of that public key. So therefore those

coins would be burned. Did you did you cover

this in class already? Maybe, maybe a little bit. So but that's kind

of inefficient because if you

remember, the miners have to build this UTXO set.

And they have to

keep this output that has this bad public

key in their memory forever because nobody's

going to be able to spend it. So we don't want to do that. We want to build a nice system,

a system that treats bitcoin nicely, the bitcoin miners. So that's why we use

these return outputs. All right, so the

high level here is that Alice gives

Bob three bitcoins. And the miners collect

a bitcoin as a fee. And of course, you can

keep doing this, right? Like Bob can give Carol these

two bitcoins later by creating another transaction with an

input referring to that output and with an output specifying

Carol's public key.

All right, and the high level

idea of bitcoin is that you don't– you cannot

double spend coins. And what that means is that

a transaction output can only be referred to by a

single transaction input. So this thing right here in

bitcoin where I have two inputs spending an output

cannot happen, right? How many of you are

familiar with this already? OK, good. So actually this is

the essential trick that Catena leverages. And we'll talk about it soon. And yeah, the

moral of the story, the reason I told you all

of this is because you know, basically if you have proof of

work consensus in the bitcoin sense, you cannot

do double spends. So this thing right

here, that I said before, just cannot occur in the Bitcoin

blockchain unless you break the assumptions, right, unless

you have more mining power than you should. In that case, you either

have to tx2 or tx2 prime, but not both, right? And what Catena

really realizes is that if I put statements

in these transactions now, what that means is that I can

only have a second statement.

I cannot have two

second statements. I cannot equivocate about the

second statements if I just restrict my way of issuing

statements in this way. I put the first statement

in the transaction and the second

statement I put it in a transaction that

spends the first one. So does everybody agree that

if I do things in this way and I want to equivocate

about the second statement, I would have to double spend? So that's the key insight

behind our system. Any questions about this so far? You know it's really hard to

talk if you guys talk back, it's way easier.

Yeah? AUDIENCE: A question. And maybe, I think I'm

getting this right. If you're setting up

the first transaction, then you're adding data on? You're burning bitcoins

every time you're doing it, so at some point,

you're going to run out. ALIN TOMESCU: That's

an excellent question. So let's– we'll go over that. But the idea is

that in this output, I won't burn any bitcoins. I'll actually specify

my own public key here. And I'll just send the

bitcoins back to myself. And in the process I'll pay a

fee to issue this transaction. Does that make sense? Yeah? And we'll talk about it later. OK, so real quickly,

what did previous work do regarding this? So how many of you are

familiar with blockstack? 1, 2, only two people? OK how many of you are

familiar with Keybase? OK, so blockstack and Keybase

actually post statements in the Bitcoin blockchain.

And they're both

public directories. They map user names

to public keys. And for example, Keybase,

what Keybase does is they take this

Merkle route hash, and they put it in

the transaction. And then six hours later,

they take the new route hash, and they put it in another

transaction, and so on. Every six hours, they

post the transaction. But unfortunately, they don't

actually do what Catena does. So they don't have their new

transaction spend the old one. And as a result,

if you're trying to make sure you see all of

the statements for Keybase, you don't have a lot

of recourse other than just downloading each

block and looking in the block for all of the

relevant transactions. Another thing you could

do is you could sort of trust the bitcoin miners– the bitcoin full nodes to

filter the blocks for you. So you could contact a

bunch of bitcoin full nodes and say, look. I'm only interested

in transactions that have a certain IP

return prefix in the data. And they could do that for you. But unfortunately,

bitcoin full nodes could also lie to

you very easily.

And there is no cost

for them to lie to you. Everybody can be a

bitcoin full node. So then it becomes a very

bandwidth intensive process because you have to

ask a lot of full nodes to deal with the fact that

someone might lie to you. But you either need to

download full blocks to find let's say, a missing

statement like this one that a bitcoin full node

might hide from you, or you can trust the majority

of bitcoin full nodes to not hide statements, which

is not very good, right? So I don't want to

trust these full nodes because all of you guys

could run a full node right now in the bitcoin network. It doesn't cost you anything. And if I talk to your malicious

full node, I could be screwed.

So our work just says, look. Instead of issuing

transactions in sort of an uncorrelated fashion,

just do the following thing. Every transaction you issue

should spend the previous one. So as a result, if someone

wants to equivocate about the third

statement, they have to double spend

like I said before. Right? Yeah? AUDIENCE: So what's

the connection back to Keybase and blockstack again? ALIN TOMESCU: Yeah, so

Keybase and blockstack are public directories.

And what they do is they want

to prevent themselves from– is there a whiteboard

I can draw here? Yeah so, let's say, you know,

if you remember the picture from the beginning, I can

have a public directory that evolves over time, right? So this is v1 of the

directory, and it might have the right public

keys for Alice and Bob. But at v2, the

directory might do this. It might do v2. It might have Alice, Bob, but

then put a fake key for Alice.

And at V2 prime, it might

do Alice, Bob as before, and put a fake key for Bob. So in other words it keeps

the directory append-only. But it just adds fake public

keys for the right people in the right version. So here this one

is shown to Bob. And here this one

is shown to Alice. So now Alice will use

this fake key for Bob. So she'll encrypt a message

with b prime for Bob. And now the attacker can

easily decrypt this message because he has the secret key. So what the attacker can

do then is re-encrypt it with the right

public key for Bob and now he can read

Alice's messages.

And the whole idea is

that the attacker– you know, this b prime is the

public key, is pk b prime, let's say. But the attacker

has this sk b prime. He knows sk b prime because

the attacker put this in there. The attacker being really,

blockstack or Keybase. And of course, they're

not attackers in the sense that they want to be good guys. But they're going to be

compromised eventually. So they want to

prevent themselves from doing things like these. Is that sort of

answer your question? Yeah. All right, so yeah, a

really simple summary. If I had two slides to summarize

our work, this would be it. Right, they would be these two. Look, don't do things this way. Do them this way. All right, so let's see,

let's look a little bit at the design. So remember we have

these authorities that could equivocate about

statements they issued like blockstack and Keybase.

So what we propose is

look, these authorities can run a lock server,

a Catena lock server. And they start with some

funds locked in some output. And what they can

do first is they can issue this

genesis transaction to start a new lock. So for example, Keybase would

issue this genesis transaction starting the log of their

public directory Merkle routes. And this genesis

transaction can be thought of as the

public key of the log. Once you have this

genesis transaction, you know it's transaction ID. You can verify any

future statements, and you can implicitly prevent

equivocation about statements. And what the lock

server is going to do is it's going to

take these coins and send them back to the

server to answer your question.

So if there was a public

key, if these coins are owned by some

public key, they're just sent back to

same public key here and paying some

fees in the process. Right, so we're not

burning coins in the sense that we're just

paying fees that are miners, which we have to do. OK, so now what you

can do is if you want to issue the

first statements, you create a transaction. You send the coins from this

output to this other output. You pay some fees

in the process. You put your statement

in an op return output. And as a result, if this lock

server wants to equivocate, it has to again,

double spend here, which it cannot do unless

it has enough mining power.

So Keybase and

blockstack, if they were to use a system

like this, they could prevent themselves

from equivocating. And this can keep going, right? So you issue

another transaction. Spend the previous output. Put the new statement. Yes? AUDIENCE: This doesn't

seem like a new problem. How have authorities prevented

equivocation in the past? ALIN TOMESCU: This doesn't

seem like a new problem. How did authorities do it? The problem is not new. The problem is eternal. So you are correct there. How did they do it in the past? They just used a Byzantine

consensus algorithm. So in some sense this is what

we're doing here as well. We're just piggybacking

on top of Bitcoin's Byzantine consensus algorithm. AUDIENCE: So you're rolling down

to a newer Byzantine consensus algorithm basically. ALIN TOMESCU: Sure, I'm not

sure what rolling down means. But yeah, we're piggybacking

on top of bitcoin. The idea is that look,

a byzantine consensus is actually quite

complex to get right. We already have a publicly

verifiable business consensus algorithm. It's bitcoin. Why can't we use it to verify,

let's say, a log of statements super efficiently? So up until our work, people

didn't seem to do this.

So Keybase didn't do this. Blockstack didn't do this. They kind of forced it to

download the entire bitcoin block chain to verify let's

say, three statements. So in our case, you only have

to download a few kilobytes of data to verify

these three statements, assuming you have the

bitcoin block headers, right, which we think is

a step forward. And it's sort of

like the right way to use these systems

should be you know, the efficient way,

not the inefficient way. Because bandwidth

is expensive, right? Computation is cheap. Bandwidth is expensive. All right, so anyway the idea is

that if the lock server becomes malicious, if Keybase or

blockstack gets hacked, they cannot equivocate

about the third statement.

They can only issue one

unique third statement. And the advantages

are, you know, it's hard to fork this lock. It's hard to equivocate

about third statement. But it's efficient to verify. And I'll walk you through

how clients verify soon. The disadvantages

are that if I want to know that this is the

second statement in the log, I have to wait for

six more blocks to be built on top of this

statement's block, right? Just like in bitcoin, you

have to wait for six blocks to make sure a transaction

is confirmed, right? Why do you do that? The reason you do that

is because there could be another transaction

here, double spending because sometimes there are

accidental forks in bitcoin and things like that.

What are some

other disadvantages that you guys can point out? Yeah? AUDIENCE: It's going

to be expensive. ALIN TOMESCU: It's going

to be expensive to issue these trends. So Alin– Alin and I

share the same name. So Alin is pointing

out that you know, every time I issue

these statements, I have to pay a fee, right? And if you remember, the

fees were quite ridiculous in bitcoin. So that's a problem, right? So let's see, is

that the next thing? The next thing was

you have to issue– you can only issue a statement

every 10 minutes, right? So if you want to issue

statements really fast. you can't do that. All right, like Alin said you

have to pay bitcoin transaction fees. And the other problem is

that you don't get freshness in the sense that it's kind

of easy for this lock server to hide from you the

latest statement. You know, unless you have

a lot of these log servers and you ask many of them, hey,

what's the latest statement? And they show you back

the latest statement.

If there is just one log

server and it's compromised, it could always

pretend no, no, no. This is the latest statement. And if you don't trust it,

the best recourse you have is to download the full block

and look for the statement yourself. So you don't get freshness. Those are some disadvantages. Now let's look at how

clients audit this log? So I was claiming that

it's very efficient to get these statements

and make sure that no equivocation happened. So let's say, you

have a Catena client and you're running on your

phone with this client. And your goal is to get

that list of statements.

And there's the Catena log

server over there in the back. And there's the

bitcoin peer to peer network which at the moment

has about 11,000 nodes. And remember, I said

the first thing you need is the genesis transaction. Does everybody

sort of understand that if you get the wrong

Genesis transaction, you're completely

screwed, right? Because it's very

easy to equivocate if you have the wrong

Genesis transaction, right? I mean, you know there's the

right GTX here where you have, let's say, a s1.

And then you have s2 in their

own transactions, right? But if there's another GTX prime

here and you're using that one, you're going to get s1 prime,

s2 prime, different statements. So if Alice uses GTX

but Bob uses GTX prime, Alice and Bob are

back to square one. So in some sense, you might ask,

OK, so then what's the point? What have you solved here? I still need to get

this GTX, right? So what we claim is that this is

a step forward because you only have to do this once. Once you've got

this GTX, you can be sure you're never

equivocated to, right? Whereas in the

past, you would have to for each

individual statement, you'd have to do

additional checks to make sure you're

not being equivocated to, like you would have to

ask in a full node, let's say.

Right, so as long as you have

the right GTX, you're good. And how do you

get the right GTX? Well, usually you ship it with

the software on your phone. And there's some

problems there as well, like there is no problem

solved in computer science in some sense. But you know, we're trying

to make progress here. OK, so let's say you have

the right GTX because it got shipped with your software. Now the next thing you want to

do is get the block headers. So you have header

i, but there are some new headers being posted. Let's say the bitcoin peer to

peer network sends them to you. You have these headers.

You verify the proof

of work, right? So this only costs you 80

bytes per header, right? Does everyone see that

this is very cheap? So far, so far I have the GTX,

which is let's say 235 bytes. And now I'm downloading

some headers. And now I'm ready to ask

the log server what's the first statement

in the log, right? And what the log

server will do is he's going to reply

with the transaction with the statement, which is

600 bytes and the Merkle proof. So all of this is

600 bytes, actually. Right, and now what the

Catena client will do is he'll check the

Merkle proof against one of the headers so to see in

which headers does it fit. And then he'll also

check that the input here has a valid signature from the

public key in the output here.

All right, I want at least

one question about this. Yeah? AUDIENCE: Sorry I came in

late, but is the Catena client over there similar to the SPV? ALIN TOMESCU: Yeah,

so that exactly. It's an SPV client. Yeah, so the idea is

that we want SPV clients. We don't want these

mobile phone clients to download 150

gigabytes of data. We want them to download let's

say 40 megabytes worth of block headers, which they can discard

very quickly as they verify. And then we want

them to download 600 bytes per

statement, but still be sure that they saw all of

the statements in sequence, and that there was

no equivocation. Yeah? AUDIENCE: So in our

previous classes, we discussed, if you can have

a full node and an SPV node, do these sort of vulnerabilities

exist with the [INAUDIBLE] client? ALIN TOMESCU: So

which vulnerabilities that you did talk about? AUDIENCE: I forget. ALIN TOMESCU: Did

you talk about– AUDIENCE: There was just a

box that was like less secure. And then there was another box

that was something else bad. There was one about [INAUDIBLE]. The clients would

lie to you about– If you say, here's

some transactions or here are some

unspent outputs, then they could just tell

you something different.

ALIN TOMESCU: Yes. Yeah? Sorry. AUDIENCE: Well,

they can't tell you that transactions

exist or don't exist. They can just not tell you– ALIN TOMESCU: Yeah, they

can hide transactions from you, which gets back

to the freshness issue that we could discussed. They could also–

this block header could be an header

for an invalid block. But remember, that before

you accept this tx1, you wait for enough

proof of work, you wait for more block

headers on top of this guy to sort of get some

assurance that no, this was a valid block because a

bunch of other miners built on top of it.

Right? So as long as you're willing

to trust that the miners do the right thing, which

they have an incentive to do the right thing,

you should be good. But like you said,

what's your name? AUDIENCE: Anne. ALIN TOMESCU: Anne? Like Anne said, there are

actually bigger problems with SPV clients. And if there is time,

we can talk about it. But it's actually easier to

trick SPV clients to fork them. And there's something called a

generalized vector 76 attack. Have any of your guys

heard about this? So it's like a pre-mining

attack but it's a bit easier to pull off. Actually, it's a lot easier

to pull off on an SPV node than on a full node.

And if there's time at the

end, we can talk about it. If there isn't, you

can read our paper, which is online on my website. And you can read about

these pre-mining attacks that work easier for SPV nodes. But anyway, this can

keep going, right? You get block headers,

80 bytes each. You ask the log

server, hey what's the next statement in the log? You get a Merkle proof

in a transaction.

And then you verify

the Merkle proof. You put this transaction

in one of these blocks and you verify that it

spends the previous one. Right, and as a

result, you implicitly by doing this verification,

by checking that hey, this is a transaction

and a valid block. This block has enough

stuff built on top of it and this transaction

spends this guy here, you implicitly

prevent equivocation. Right, then you don't have

to download anything else. Right, you only have to

download these Merkle proofs and transactions in

these block headers. Whereas in previous work, you

could be missing these s1's, these s2's, they

could be hidden away in some other branch

of the Merkle tree. And you'd have to do

peer to peer bloom filtering on the full nodes. And those full nodes

could lie to you.

Yeah, so the bandwidth

is actually very small. So suppose we have

500k block headers– I think bitcoin has a

bit more right now– which are 80 bytes

each and we have 10,000 statements in this

log, which are 600 bytes each. Then we only need now

with 46 megabytes, right? What's the what's the

other way of doing it? You have to download

hundreds of gigabytes. All right, so let's talk about

scalability a little bit. So suppose the system

gets deployed widely. Let's say Whatsapp starts to

use the system to witness– to publish their public

directory in bitcoin, right? And everybody, a lot of

you here have Whatsapp. And this is you guys. Let's say there are 200,000

people using Whatsapp. I think there's

more like a billion. So what are they going to do? Remember that part of

the verification protocol is asking for

these block headers from the peer to

peer network, right? And in fact, if

you're SPV clients, you usually open up around

eight connections to the peer to peer network.

And if you're a full node in the

bitcoin peer to peer network, you usually have around

117 incoming connections. That that's how

much you support. You support 117 incoming

connections as a full node. So that means in total,

you support about a million incoming connections. So you know, this guy

supports a million. But we need about 1.6

million connections from these 200,000

clients, right? So it's a bit of

a problem if you deploy Catena and it

becomes wildly popular. Being a bit optimistic

here, but you know, let's say that happened, right? So how can we fix this? How can we avoid this problem

because in this case, what we would basically

be doing is we would be accidentally

DDOSing bitcoin. And we don't want to do that. Does everybody see that there's

a problem here, first of all? OK, so the idea is very simple. We just introduced something

called a header relay network. And what that means is

look, you don't really have to ask for these block

headers from the Bitcoin peer to peer network.

You could just outsource

these block headers anywhere because they're

publicly verifiable. Right, the block headers

have proof of work on them. So you can use volunteer

nodes that sort of push block headers to whoever

asks for them. You could use blockchain

explorers like blockchain.info, right? You could use Facebook. You could just post block

headers on Facebook. Right, like in a Facebook feed. You could use Twitter for that. You could use GitHub gists. You know, so you could– there's a lot of ways

to implement this. The simplest way is

have servers and have them send these headers

to whoever asks for them. So it's easy to

scale in that sense because if you now

ask these header relay network for the

block headers, you know, it's much easier to scale

this than to scale the bitcoin peer to peer network, which

has to do a bit more than just block headers.

They have to verify blocks. They have to verify signatures. Yeah? AUDIENCE: Did you

consider having the clients being peer to peer? ALIN TOMESCU: ,

Yes so another way. And I think we'll talk

about that in the paper– is you can implement the header

relay network as a peer to peer network on top of the clients. Yeah, so that's

another way to do it. There's some subtleties there

that you have to get right. But you can do it, I think. Yeah? AUDIENCE: Would you you expect

that if a company like Whatsapp decided adopt Catena, they

would run their own servers to make sure that there

was the capacity for it? ALIN TOMESCU: For the

header relay network? AUDIENCE: Yes. ALIN TOMESCU: I mean, I

would be just be speculating, wishful thinking. They could. There is some problem with this

header relay network as well. And we talk about

it in the paper because this had a really

network could withhold block headers from you. So you do have to distribute it. Like usually you don't

want to just trust Whatsapp who's also doing

the statements, who's also pushing the statements

in the blockchain.

You don't want to trust

them to also give you the block headers. You actually want to fetch

them from a different source that Whatsapp

doesn't collude with. Yeah, Anne, you had a question? AUDIENCE: Are there other

header relay networks that are deployed already? ALIN TOMESCU: Yeah, there

was actually one on ethereum. There's a smart

contract in ethereum, I think, that if you submit

bitcoin block headers to it, you get something back. And then you can just

query bitcoin block headers from the ethereum blockchain. Is anyone familiar with this? So I guess I didn't

include it here. But another way to do it is

to just publish the header is in an ethereum

smart contract. Yeah. So there's crazy ways

you could do this too. Yeah? AUDIENCE: Will that

one go out of gas? I don't know, my understanding

of ethereum is pretty decent, but would that smart contract

eventually run out of gas and not publish anymore? ALIN TOMESCU: So to fetch from

it, you don't need to pay gas. But I suspect to push

in it, I actually don't know who

funds that contract.

So I guess you fund that

when you push maybe. Maybe not because then you

also want something back. Why would you push? I'm not sure. But we can look at it after. Yeah. It's a good question. So anyway, even if this header

relay network is compromised, if you implement it

in the right way, you've distributed on a

sufficient number of parties, you can still get all of the

properties that you need to, meaning freshness for

the block headers. That's really the only

property that you need to. The header relay

network should always reply with the

latest block headers. So let's look at costs since

Alin was mentioning the costs. So to open a statement, you have

to issue a transaction, right? And the size of our transactions

are around 235 bytes. So and the fee as of December

13 was $16.24 for transactions if you guys remember

those great bitcoin times. I think it went up to

$40 at some point too. So it was it was really hard

for me to talk to people about this research back then.

But guess what,

the fees are today? So today, this

morning I checked. And there were $0.78, right? When we wrote the paper,

they were like $0.12. So you know, here I

am standing in front of you pitching our work. In two minutes they could be

back to $100, but who knows? Yes, you had a question. AUDIENCE: Maybe I'm wrong,

but in a transaction, you can have some outputs. Can you have several

statements in there? ALIN TOMESCU: So

that's a good question. So can you batch statements? And then the answer is yes. You can definitely

batch statements. What we've said so far

is in a transaction– in a Catena transaction,

you have this output.

And you have this

op return output where you put the

statement, right? And you know, it spends

a previous transaction. But as a matter of fact, what

you can do and some of you may already notice this. There is no reason to put

just one statement in here. There is some reason–

so the only reason is that it only fits 80 bytes. So you could put easily, let's

say, two or three statements in there if you hashed them

with the right hash function. But a better way to do

it is why didn't you put here a Merkle root hash? And then you can have

as many statements as you want in the leafs

of that Merkle tree, right? In fact, here you could

have I don't know, billions of statements.

So keep in mind,

you will only be able to issue billions of

statements every 10 minutes. But you can definitely

have billions of statements in a

single transaction if you just batch them. So now, remember the blockchain

will only store the root hash. This Merkle tree will be stored

by the log server perhaps or by a different party. They don't have to

be the same party. Does that make sense? Does that answer your question? Yeah. Right, that was my next point. Statements can be batched

with Merkle trees. OK, so let's talk about

the why since so far we've been talking abstractly

about these statements. But what could these

statements actually be. So let's look at a

secure software update. So how do you do

secure software update? An example attack on a

software update scheme is that somebody compromises

the bitcoin.org domain. And they change the bitcoin

binary to a malicious binary. And they wait for people to

install that malicious binary. And then they steal their coins. They steal their data.

They could execute

arbitrary code. And an example of this was

sort of this binary safety warning on the bitcoin website. At some point, they

were very concerned that a state actor is going

to mess with the DNS servers and redirect clients

to a different server and make them download

a bad bitcoin binary. So does the attack make sense? Does everybody see

why this is possible? You do need to sort of accept

that the DNS service that we currently have on the internet

is fundamentally flawed.

It's not built for security. So the typical defense the

typical defense for this is that the Bitcoin developers–

they sign the bitcoin binaries with some secret key. And they protect

that secret key. And then there's a

public key associated with the secret key that's

posted on the bitcoin website, right? And maybe some of you'll

notice that sometimes it's also very easy to change the

public key on the website, you know, if you

can just redirect the victim to another website. And another problem is that not

everyone checks the signature. Even if let's say you have the

public key on your computer, you know what the

right public key is, only if you're

like an expert user and you know how to use GPG,

you will check that signature, right? And the other problem

that's probably I think a much, much

bigger problem is that for the bitcoin

devs themselves, it's very hard to detect if

someone stole their secret key.

Like if I'm a state actor

and I break your computer and I steal your secret key, I

will sign this bitcoin binary. And I'll give it to

let's say, one guy. I'll give it to you. You know, and I'll just

target you individually because I'm really– I know you have

a lot of bitcoin. Right, and then the bitcoin devs

will never find out about it unless you know you kind

of realize what happened. Then you take your

bitcoin binary and you go with it

to the bitcoin devs. And they check the signature

on it and they say, oh wow. This is a valid signature

and we never signed it. So somebody must have

stolen our secret key. So this is really a bad– kind of the core

of the problem is that it's hard for

whoever publishes software to detect that

their secret key has been stolen– to detect

malicious signatures on their binaries. Does that make sense? So the solution, of course,

is you know, publish the signatures of bitcoin

binaries in a Catena log So now if there's a malicious

binary being published by a state actor, people

won't accept that binary unless it's in the

Catena log, which means people in the bitcoin

devs will see the same binary.

Right, so let me let me show

you what I mean with a picture. So we have this Catena

log for Bitcoin binaries. And let's say, the

first transaction has a hash of the bitcoin

0.001 tar file, right, the bitcoin binaries. And this hash here

is implicitly signed by the signature in

this input because it signs the whole transaction. So now if I put this

hash in a Catena log, I get a signature

on it for free. And now, if let's say, a state

actor compromises the log server, gets the

secret key, he can publish this second malicious

binary in the log, right? But what that malicious

state actor will want to do, he will want to hide this

from the Bitcoin devs and show it to all of you guys.

All right, so he'll

want to equivocate. So as a result, he will want to

create a different transaction with the right

bitcoin binary there, show this to the bitcoin devs

while showing this to you guys. All right, so the bitcoin

devs would think they're good. This is the binary they wanted

to publish while you guys would be using this malicious binary

published by the state actor. Of course this cannot happen

because in Catena you cannot equivocate. Right? Does everybody see this? Right, any questions about this? There has to be a

question on this. No? So this mechanism is called

software transparency. It's this idea that rather

than just downloading software like a crazy person from the

internet and installing it, we should just be

publishing these binaries in a log that everybody can see,

including the software vendors that created those binaries.

So in this way, if somebody

compromises a software vendor, that vendor can

notice that in the log there's a new version

for their software that they didn't publish. So you know, this isn't to say

that it'll prevent attacks. You know, what a state

actor can do anyway is they can just do this. They can post this

H2 prime in here, show it to you guys

including the bitcoin devs and still screw everyone over.

But at least these attacks

then go undetected anymore. All right, so it's a step

forward in that sense. Yes, so the idea

is that you have to double spend to equivocate. And the other

example that really– the reason I wanted

to start this research had to do with public

key distribution. So let's say we have

Alice and we have Bob. And they both have

their public keys. And I'm using this

letter b to denote Bob and his public

key and the letter a to denote Alice

and her public key. And they have their

corresponding secret keys, right? And Alice and Bob, they want

to chat securely, right? So they want to set

up a secure channel. And there's this directory

which stores their public keys. So this guy stores

Alice, pk Alice.

This guy stores Bob, pk Bob. All right, and the directory

gets updated over time, maybe Karl, Ellen

and Dan registered. And if you have

non-equivocation, if the attacker wants to

impersonate Alice and Bob, he kind of has to put

their public keys, the fake public keys

in the same directory, which means that when

Alice and Bob monitor– they check their

own public keys, they both notice they've

been impersonated, right? So again, the idea is

that you can detect. Now how can this

attacker still trick Alice to send an

encrypted message to Bob with Bob's fake public key? Is there a way even if

you have non-equivocation? So what's the attack? Even I have

non-equivocation and I claim that the

attacker can still get Alice to send a fake,

an encrypted message to Bob that the attacker can decrypt. What should the attacker do? So pretend that we are

here without the ability to equivocate.

So the attacker

cannot equivocate. But I claimed that

the attacker can still trick Alice into

sending a message to Bob that the attacker can read. So now it's time to see if

you guys paid attention. Somebody? Alin? Oh, you? AUDIENCE: Does the attacker

have to have the secret key? ALIN TOMESCU: No, no. He does not. Yeah. He does not have to

have the secret key. The attacker just

creates fake public keys. Here's a hint. AUDIENCE: If you only

changed one person to choose, they don't know that it's a

fake key so they could send it to a fake key for a bit? ALIN TOMESCU: Yeah, so

whose person should they attack or change the key for? AUDIENCE: Like if they

change Bob's, Alice will still think

Bob's is correct so she'll send it to the

fake Bob until Bob checks it.

ALIN TOMESCU: Exactly. So that's exactly right. So what's your name? AUDIENCE: Lucas. ALIN TOMESCU: Lucas. So what Lucas is saying is

look, even without equivocation, I had this directory at T1. I had another one at T2. But at T3 and both of these had

keys for Alice and Bob, right? But at T3, Lucas is saying look,

just put the fake key for Bob here. And that's it. Don't put a fake key for

Alice there, just for Bob.

And now when Alice looks up

this public key for Bob here, she sends a query to

the directory hey, what's Bob's public key? She gets back b prime,

which is equal to Bob pk Bob prime, right? Alice can't tell if that's

really Bob's fake public key. That's the reason she's

using the directory in the first place. She wants sort of a trustworthy

place to get it from. Bob can tell if Bob looks. But by the time Bob looks,

it might be too late. Alice might have already

encrypted a message, right? So again, what's the point

of doing all of this? It's not like you're

preventing attacks, right? And the point of

doing all of this is that you get transparency. Bob can detect, whereas

right now Bob has no hope. In fact, so you said, a

lot of you use Whatsapp. So you know in

Whatsapp, if you really want to be sure, so I

have a conversation here with Alin Dragos.

So, Alin, do you what to

to bring your phone here? Do you have Whatsapp? So if you really want

to be sure that you're talking to the real Alin

and not some other guy, you have to go on

this encryption tab. Can you tape this? So my phone is black and white. It's going through

a depression phase. I apologize. So you have to go here and

there's a code here, right? And Alin, can you

do the same thing? You know what I'm talking about? I really hope I don't get some

weird text message right now with the camera on the phone.

OK, so now with Alin's

phone, is that the same code? Can somebody tell me? I can't see it. AUDIENCE: It's hard to see. ALIN TOMESCU: OK, so

we have 27836 and yeah. So it's the same code. Can you see it on the camera? So now because we have

the same code here. With this code

here, it really is a hash of my public key

and Alin's public key. And if we've got the same hash

of both of our public keys, then we know we're

talking to one another. But we won't really know that's

the case until we actually meet in person and do

this exchange, right? So what this system

does instead is it allows Alin to check

his own public key and it allows me to

check my own public key. This way if we check

our own public key, we'll always know when we're

impersonated even though I might send an encrypted

message to the wrong Alin, Alin will eventually find out. It's a bit confusing because

we're both called Alin.

So does that sort

of makes sense? Yeah? AUDIENCE: So what do

you do when you realize that your key is the wrong key? ALIN TOMESCU: Good question. So that's really the

crucial question. What the hell can you do? Right, so this directory

impersonated you. In fact, you can't even– here's the problem. If you're Bob here and you

see this fake public key. And you go to the New

York Times and you say hey, New York Times,

this Whatsapp directory started impersonating me. And the New York Times

can go to the directory and say, hey directory, why

did you impersonate Bob? And the directory can say,

no, I did not impersonate Bob.

Bob really just ask

for a new public key. And this was the public

key that Bob gave me. And it's just a he said, they

said, kind of a thing, right? So it's really a sort

of an open research area to figure out what's the right

way to whistle blow here. So for example, one project

that we're trying to work on is there a way to track

the directory somehow so that when he does

stuff like this, you get a publicly verifiable

cryptographic proof that he really misbehaved, right? No, there's no

cryptographic proof. The fact that that

public key is there could have come from

the malicious directory or could have come

from an honest Bob who just changed his public key. So yeah. So again, a step forward

but we're not there. You know, it's just that there's

much more work to do here. And I think you

also had a question. AUDIENCE: Can't Alice just

ask Bob if this is you? ALIN TOMESCU: So that's a

chicken and an egg, right? So we have Alice.

We have Bob. And we have the attacker. Alice asks Bob, is

this your public key? You know, let's say, b prime. Let me make this more readable. So attacker, right? So Alice asks, hey Bob. Is this b prime your public key? The attacker changes it. Hey Bob, is b your public key? The attacker– Bob says yes. Attacker forwards

yes to Alice, right? Remember, Bob and Alice

don't have a secure channel. That's the problem we're trying

to solve with this directory, right? So the attacker can always

man in the middle people. Well, people like Alice and Bob.

If the attacker can man

in the middle everything, then there's really no hope. And we're living in a very sad,

sad world if that's the case. Yeah, it actually might

be the case but we'll see. Anyway, so yeah, so I claim here

that this is a step forward. But there's still

much work to do. All right, so we

get transparency. Bob can detect. He'll know. He won't be able to

convince anybody. But if a lot of Bobs

get compromised, you're still like in a

place where everybody knows that something's off and

will all stop using Whatsapp, for example. Right? By the way, Whatsapp

is a great tool. You should continue using it. I'm just saying it's

difficult to use right like if somebody really

wants to target it, they can play a lot of

tricks to still trick you. So yeah, so all right, we

already talked about this. And yeah, again if the director

can equivocate, then you know, all bets are off because now

Bob will look in this directory, he'll think he's

not impersonated.

Alice will look

in this directory. She'll think she's not

impersonated, right? So the reason we

started this research is because I really want to– my thesis is on building

these directories that are efficiently auditable and

have a hard time impersonating people. So that's why we decided

to look at how could you do this with Bitcoin. Yeah, so of course there's

one project called KeyChat that we're working on with

some high school students.

And we're using the key

based public key directory. And we're witnessing

it in a Catena log so that stuff like

that doesn't happen. OK, so now let's talk

about the blockchains. In general, people

nowadays like to say I need a blockchain for x, right? I need a blockchain for

supply chain management. I mean a blockchain

for cats, for whatever. I've heard a lot

of crazy stories. IOT, self-driving

cars, blah, blah, blah. And I think the right way

to think about blockchain is to never ever say

that word unless you use quotes, first of all. And second of all, to

understand what Byzantine state machine replication is. Right, and if you understand

what Byzantine state machine replication is or a

Byzantine consensus, you understand blockchain. And you understand all the hype. And then you can make some

progress in solving problems. In the sense that

what is blockchain? So what we're

doing here is we're doing a Byzantine

consensus algorithm.

We're agreeing on a

log of operations. Right, by the way, that's

what Catena does too by piggybacking on bitcoin. It agrees on a lot on

a log of operations. Right, but the other thing that

SMR or Byzantine consensus does is that it also

allows you to agree on the execution of

the ops in that log. So in Catena, you don't

agree on the execution, you just agree on

the statements. But there is no execution of

those statements in the sense that you can't build

another bitcoin on top of bitcoin in Catena

because you can't prevent double spends of

transactions that are Catena statements, right? Like the Catena statements,

you have to look in each one and tell if it's correct. So to detect a double spend in

a Catena backed cryptocurrency, you would have to download

all of the transactions and because you cannot execute

it like the bitcoin miners do and build this UTXO set.

I'm not sure this is

making a lot of sense. But let's put it another way. In bitcoin, you have

block one and then you have block two, right? And there's a hash pointer and

there's a bunch of transactions here, right? And remember that what prevents

me from double spending something here– I can have two

transactions in this block that double spend

the same one here. What prevents me from doing

that is exactly this execution stage, right? Because in the execution stage,

when I try to I execute this first transaction and I

mark this output as spent, when I execute the

second transaction, I cannot spend that

output anymore, right? In Catena, you can't do anything

like that with the statements. You just agree on

the statements.

In Catena, you would

put this transaction in the log, this one and then

that one and someone would have to detect that the second

one is a bad one by actually downloading it. That's kind of what

I'm trying to say here. So in general,

the way should you should be thinking

about blockchain is through the lens of

Byzantine consensus. And that'll get you

ahead of the curve in this overly

hyped space, right, because it's really just this. You're agreeing on

a log of operations. And then you're agreeing on the

execution of those operations according to some rules. The rules in bitcoin

are transaction cannot– there cannot be two inputs

spending the same output more or less. There's other things too. What that gives you

is it allows you to agree on a final state

which in bitcoin are the valid transactions.

That's the final state right. In ethereum, for

example, the final state are the valid transactions,

and the account balances of everything,

and the smart contract state for everything. And I guess you'll

learn about that later. So you can build

arbitrarily complex things with Byzantine consensus

or with blockchains. And the high level bit, if you

want to look at it another way, is that you have a program p,

right, which could be anything, could be a cryptocurrency. And then, instead of

running this program p on a single server s,

what do you do is you distribute it on a bunch of

servers, s1, s2, s3, s4, right? And now as a result, to

mess with this program p, it's not enough to

compromise one server, you have to compromise

a bunch of them.

Right? OK so, and some

of you might also be familiar with this term

permissioned blockchain. So when you distribute this

program o amongst n servers where n is equal let's

say, three f plus 1 and f is equal to 1 in

this particular case. In a permission blockchain,

this n is fixed, right? Once you've set n to

4, it has to stay 4. These servers have

to know one another. They need to know each

other's public keys. And only one of the servers,

f is equal to 1, can fail. If more than one server

fails, then all bets are off. Your program can start

doing arbitrary things.

In particular, if your

program is bitcoin, it can start double spending. I'm moving a little bit fast,

so I'll take some questions up until this point before I go on. Yes? AUDIENCE: In a

permissioned blockchain, do they use proof of work? ALIN TOMESCU: No,

you don't have to. And that's kind of

what the hype is about. This stuff, there is like– the first interesting

paper on this was 1976 or something like that.

So this is 40-30,

40-year-old research. We've known how to do

permissioned consensus– we used to call it Byzantine

consensus for 30 or 40 years, right? So there's nothing new there. It's just that it's very useful

nowadays to say blockchain then to say consensus

because then you get 10 more million from your

venture capitalist folks. AUDIENCE: But if you don't

have to do proof of work, do they ever do proof of work? ALIN TOMESCU: It would

be such a bad idea technically to do prefer

working a permissioned consensus algorithm. It just– completely

unnecessary, plus probably insecure too.

Yeah, so now the reason

you do proof of work is because in a

permissionless blockchain, this n is not fixed. n could go, let's say, n was 4. It could go to 8. Then it could go to 3. Then it could go to 12. In other words, people

are joining and leaving as they please. And the reason you

need proof of work in bitcoin, one way

you can look at it is that you're really turning

a permissioned consensus algorithm into a

permissionless one. And a consensus

algorithm is just voting. These n folks are just voting. And you need 2f plus 1 votes

to sort of move on, right? And if this n changes over time,

like if the n becomes bigger, it's very easy to take over

a majority of the voters. If I can just add fake voters

to a permissioned consensus algorithm, I can just take

over the consensus algorithm. In other words, I can take

over more than f nodes.

Right, so the trick

there is you have to prevent that from happening. And the only way to

prevent that is to say, look if you're going to join

and then make my n bigger, you better do some work. So that it's not

easy for you to join because if you're a bad guy

and you want to join, you know, you can do that

very easily unless I require you to do some work. So that's kind of

the trick in turning a permissioned

consensus algorithm into a permissionless one.

And in fact, the way these

permissioned animals work is completely

different than bitcoin. They are much more complex. Bitcoin is incredibly simple

as a consensus algorithm. If you ever read a

consensus algorithm paper, you know, it's a bit insane. Also to implement,

it's a bit insane. Bitcoin is very simple

to implement compared to these other things,

I mean, bitcoin is, of course, a complex

beast as well. But you should look at let's

say, practical Byzantine fault tolerant paper, PBFT, and

try and implement that. So anyway, why am I

telling you all of this? The reason I'm telling

you all of this is because if you want to

do a permissioned blockchain for whatever reason,

one way to do that is to use your favorite

Byzantine consensus algorithm.

So that would be– let's say pbft. This was 1999 from MIT. So you could use that. You could have a lot

of fun implementing it. Another thing you could do is

you could take your program p and just give it to an

ethereum smart contract. And you know, that the

ethereum smart contract, if the ethereum security

assumption holds, it will do the right thing. It will execute your

program p correctly, right? But the other thing that

you could do actually, is you could use Catena

to agree on these logs, on the log of operations

for your program. And then you could use another

2f plus 1 servers or replicas to do the execution

stuff so that you can agree on the final state. And this gives you a very simple

Byzantine consensus algorithm. So remember Catena doesn't

give you execution. It allows you to agree

on the log of ops. To get the execution, you'd

basically take a majority vote. If you see you have 2f

plus 1 replica servers and if you see f plus 1

votes on a final state, you know that's the right

state because only f of them are malicious.

So in fact, if you use Catena

with 2f plus 1 replicas, I claim that you can get sort of

a permissioned blockchain that sort of leverages the bitcoin

blockchain to do the agreement on the log of ops. So in that sense, it's sort

of a mix of a permissioned and permissionless. We haven't studied

this like we don't know what properties it would have. So that's future work. And if you don't need the

execution, for example, if all you're doing

is you're agreeing on a public key directory–

like here, there's no execution. This directory just is

supposed to stay append-only, we have some

research that allows you to prove that

every transition is an append-only directory.

And if you only

need execution, you can just use Catena

directly as I already told you guys for the

software transparency application for the public

key directory application. And if you want to do a

permissionless blockchain then, of course, you would

have to roll your own. But you have to proceed

with caution there, right? It's not an easy thing to do. OK, so let's conclude now.

What we did here is that we

enabled these applications to efficiently leverage

bitcoin's consensus, right? So clients can download

transactions selectively rather than full blockchain

and prevent equivocation. Right, and you only need

to get 46 megabytes instead of gigabytes from the

Bitcoin blockchain. So why does this matter? These are just I think

the three killer apps– secure software update,

public key directories– by the way, the

public directories also are applicable to https. So when you go on

Facebook, you have to get Facebook's public key.

The certificate authorities

that sign the public keys are often compromised. So they're often fake

search for Google, for big companies like that. And you might use it. But if you have a

public key directory, Facebook and Google

can immediately notice those fake sorts. It's a step forward. And for more, of course,

you can read our paper. It appeared in a IEEE

security and privacy 2017. And I'll post the

slide on GitHub too. So there are links there. Yeah so, again this is the high

level overview of everything that's previous

work and our work. The difference is very small. And now we can also

talk about other stuff. In fact, I have

more stuff to talk.

But before we do, I'd like to

have a discussion with you guys if you have questions. So? AUDIENCE: So could you implement

Catena in the actual bitcoin node? Would that be something

that they would want? It seems like it would

be a good feature to add? Or is it strictly separate? ALIN TOMESCU: Yeah, I

don't think you need to. That's the whole point, right? The whole point

of the research is how do we use bitcoin without

getting the miners to accept a new version of bitcoin,

without changing bitcoin in any way? So no, I don't think–

there's nothing to do really, we're just– we're taking bitcoin

as it is and we're piggybacking on top of it.

We couldn't change it. I mean, there's a lot of things

you can do in some sense. But then you get a

very different system. Very different, we can talk

about it more if you want. Yeah? AUDIENCE: You were talking about

how you can use this system to verify software

binaries and how you want this to run in

SPV modes on phones So how do you install

software on the phones say, through apple and the app store. Is there a way to sign the

binary that you actually get from the app store? ALIN TOMESCU: I think your

question is really about how do appstore binaries– how do you Verify

App store binaries? It's a chicken and an

egg in some sense right, is that what you're saying? Yeah, you're right. Eventually, I mean

in the best case, wishful thinking would

be to say that look, the app store does this

already for all of the binaries that they publish, allowing the

developers to make sure nobody is posting malicious binaries

on the app store for them.

Yes? AUDIENCE: Who do you

envision running it? ALIN TOMESCU: So I'd really

like to see Keybase run Catena, it seems like a

missed opportunity that they don't do this. I'm sure they have better stuff

to do but it's just really easily allow Keybase– let's say Keybase has

a mobile phone app, it would allow that mobile phone

app to verify the directory and get much, much,

much more security. You know, no equivocation as

long as nobody forks bitcoin. Since Keybase is already

publishing these digests but they cannot be audited

efficiently on a mobile phone. I mean they can but

not securely you know, because full nodes can lie. So there's a big problem with

everything I said so far. And nobody caught it. So one problem is

that what do you do when you run out of funds? Remember I said the log server

starts with two bitcoins. Let's say it issues

thousands of transactions, starts paying those $40 fees

and it runs out of funds. What do you do? Then Yeah? AUDIENCE: You can maybe

reload the new transactions with this transaction

[INAUDIBLE].. ALIN TOMESCU: What's your name? AUDIENCE: Raul.

ALIN TOMESCU: Raul. So Raul is saying

you can reload. And that's exactly right. We just have to change the

transaction format slightly. We talk about this

in the paper as well. But just to demonstrate

real quickly. Suppose, let's take a ridiculous

example which hopefully will never happen in bitcoin. But suppose that the

Bitcoin fee is 1 bitcoin. So now I have one bitcoin here. And I have s1 here. And now I have

zero bitcoins here. All right, so zero

bitcoins in this output. And maybe s2 here. So that would be terrible. Right, now I can't go on. Does everybody see

this as a problem? Right, so what Raul is saying

is look at another input here and make it take coins

from some other transaction whatever, 20 bitcoins.

And now you get

20 bitcoins here. Right, so you can easily

refund transactions. There is a bit more

subtlety there in the sense that you don't

want to join logs– let's say if you have two

logs, GTX and GTX prime for different applications. Right, and they start

issuing statements– s1, s2. You don't want to

be able to join– I'm sorry, s1, s1 prime– these two locks to a single

log for certain reasons right. But this doesn't actually

allow you to join them in the sense that– let's say you actually

do this and join them. Right, so let's say

this transaction here came from GTX prime, right? And there was an s1 prime here.

And you did this, right? So the problem is this is

no longer a valid Catena transaction for this log

because a valid Casino transaction– the

first input spends the previous

transactions output. But in this chain, it's

the second input that spends the previous output. So I cannot join logs. And this matters for

a bunch of reasons that we don't have to go into. Yeah, so we talked about the

about batching statements. I want to show you guys

some previous work, so how did some previous

work do this since there we seem to have a bit of time. OK, so there are

some previous work called liar, liar,

coins on fire. Have you guys seen this? So the idea here is that it

is a really nice piece of work and lots of people in

the bitcoin community already know about this.

And I think it was an idea

before the paper or maybe not, I'm not sure. But Tadge has a similar idea. So for example, suppose

we have this authority. Imagine this is a

Catena block server and it publishes a transaction

which locks to bitcoin and locks those bitcoins

to that public key. And this authority

sometimes will want to say two different things. It will want to say

s and s prime, right? And it will sign the statements

with their secret key. But the secret key

that the authority uses to sign statements is

also a bitcoin secret key. It's the same secret

key that the authority used to lock to bitcoins,

so $20,000 or something. I'm not sure if bitcoin

plummeted since yesterday, can never be sure. Does the setting make sense? So I have an authority. It issues statements

just like before. And it numbers them

with i, let's say. And we want to prevent this

authority from equivocating. We're not actually

going to prevent it. We're just going to

disincentivize it in the sense that if this authority

equivocates like this for the same statement

i, what I claim is that anybody can then

steal that authority's bitcoin because

equivocating like this reveals the secret key.

And the reason it

reveals the secret key is because the signature

shares the same i here. So how many of you

guys actually, you did cover Schnorr

signatures, right? So did Tadge talk about how

to do this with Schnorr? AUDIENCE: This is

the [INAUDIBLE].. ALIN TOMESCU: But

did Tadge cover it? AUDIENCE: Yes. ALIN TOMESCU: OK, great. So yeah so let's go

over that less briefly. So again, the idea is that

if someone observes these two signatures on conflicting

statements for the same i, there is this box where you

can put the two signatures and get back the secret key. And once you have

the secret key, we can spend this

transaction and get that authority's bitcoins. And then there's

a lot of details to get it right because

you might notice that if the authority does

this, before they do this, they might already be spending

this transaction themselves so as to prevent

you from taking it.

And details on how to prevent

the authority from doing that are in those paper. Yeah, and then you

know, whoever discovered this can spend those bitcoins. And the idea is that this

disincentivizes equivocation by locking these funds

under the secret key of the bad authority. But it does not prevent it. Right, so in Catena we

actually prevent equivocation. We say, if you

want to equivocate, you better fork bitcoin. Here they say, if you